Why Track? The Importance of Portfolio Monitoring

Tracking your crypto portfolio helps you stay informed about your investments’ value and performance. The volatile nature of cryptocurrencies means prices can change rapidly, affecting your portfolio’s worth daily. By monitoring your holdings, you can spot trends, rebalance assets, and make timely decisions to protect and grow your investment.

Top Tools: Platforms to Simplify Your Tracking

Several tools cater to both beginners and advanced users. Here are some of the most popular and user-friendly options:

- CoinMarketCap Portfolio: Easy to use, integrates real-time prices, and offers mobile apps.

- Blockfolio (now FTX): Mobile-first app with alerts, news, and portfolio analytics.

- Delta: Supports thousands of coins and multiple exchanges with detailed tracking.

- CoinStats: Offers portfolio syncing with exchanges and wallets for automatic updates.

- CryptoCompare: Web-based tracker with advanced charting and historical data.

Tracking Steps: Setting Up Your Portfolio

1. List Your Holdings

Start by recording all your crypto assets, including tokens, amounts, and the wallets or exchanges where they’re held.

2. Choose a Tracking Tool

Select a portfolio tracker and create an account if needed. Many allow manual input or automatic syncing with wallets and exchanges.

3. Input Your Data

Enter your holdings manually or connect your wallets and exchange accounts for real-time updates. Be sure to verify syncing permissions and privacy settings.

4. Customize Alerts and Views

Set price alerts and configure your dashboard to highlight key metrics like total value, profit/loss, and allocation percentages.

Pro Tips: Getting the Most from Your Portfolio Tracker

- Regularly update your portfolio, especially after trades or transfers.

- Use alerts to notify you of significant price changes or portfolio milestones.

- Review performance over different timeframes (daily, weekly, monthly) to spot trends.

- Consider tax implications and export transaction reports when needed.

- Protect your account with strong passwords and two-factor authentication.

FAQs: Common Questions About Portfolio Tracking

Q: Can portfolio trackers access my funds?

A: No, portfolio trackers only read public data or synced balances. They do not have permission to move your funds.

Q: Are there free portfolio tracking tools?

A: Yes, many popular tools offer free versions with basic features suitable for most beginners.

Q: How often should I update my portfolio?

A: If using manual input, update after each transaction. Automatic syncing tools update continuously or on demand.

Q: Can I track NFTs or DeFi assets?

A: Some advanced trackers support NFTs and DeFi tokens, but features vary by platform.

Q: Is it safe to connect my wallets to portfolio trackers?

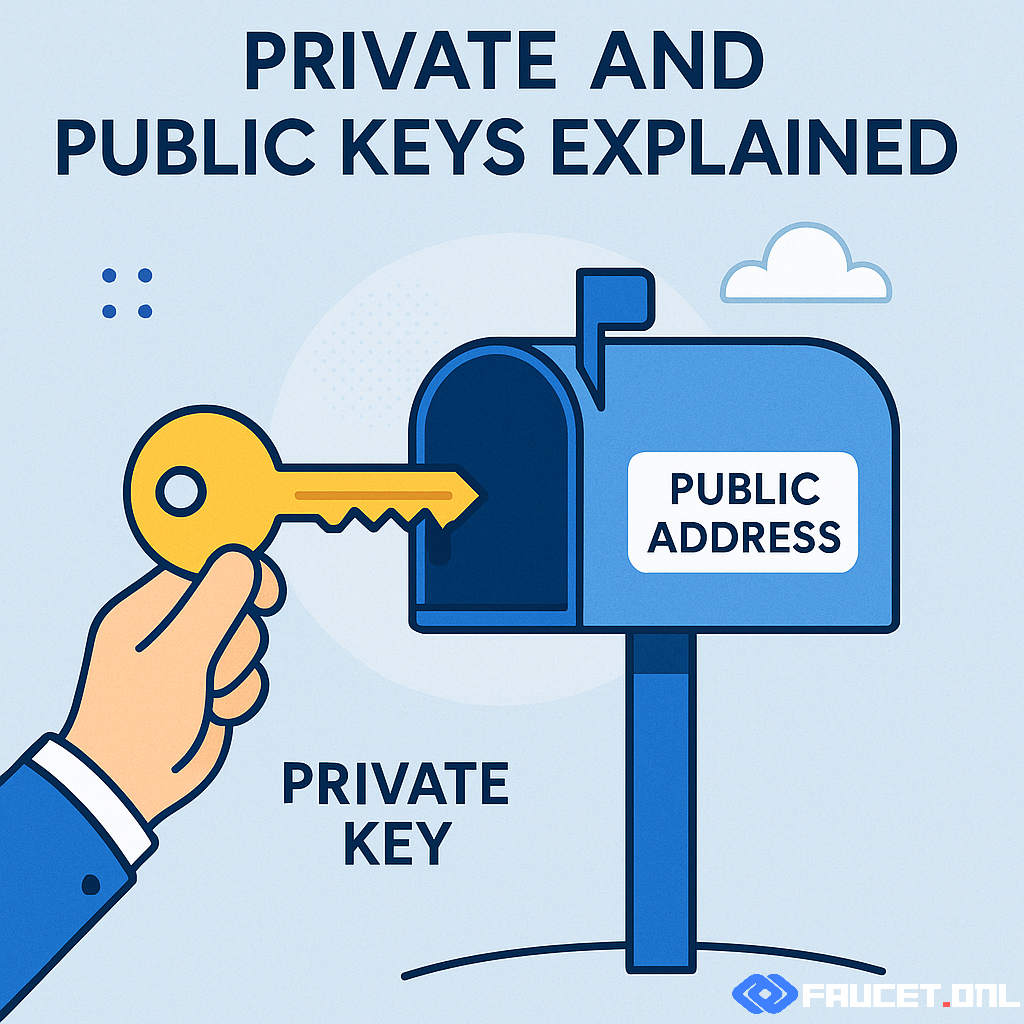

A: Generally, yes, if you use reputable apps and only grant read-only permissions. Avoid sharing private keys or full wallet access.

Effective portfolio tracking helps you make smarter decisions and maintain control over your crypto investments. With the right tools and habits, you’ll stay organized and prepared in the fast-paced crypto market.